10 US Stocks in AI Worth Watching for Growth in 2025

Image Source: Jakub Żerdzicki | Splash

Artificial Intelligence continues to redefine industries, offering unprecedented opportunities for innovation and profitability. As we approach 2025, several U.S.-based companies are poised to lead the AI revolution. Below is a detailed analysis of 10 stocks that investors may want to monitor for significant growth potential in the AI sector.

1. NVIDIA (NVDA)

NVIDIA's journey into AI began in the mid-2000s when it recognized that its GPUs, initially designed for rendering graphics, were well-suited for parallel processing tasks essential in AI computations. In 2006, NVIDIA introduced CUDA, a parallel computing platform and programming model that allowed developers to utilize GPUs for general-purpose processing. This innovation enabled significant advancements in deep learning, as researchers could now train complex neural networks more efficiently. By 2012, GPUs had become instrumental in AI research, with models like AlexNet leveraging NVIDIA's hardware to achieve breakthroughs in image recognition tasks.

Building on this foundation, NVIDIA developed specialized hardware and software solutions tailored for AI applications. The DGX systems, introduced in 2016, provided integrated solutions for AI research, combining multiple GPUs with optimized software to accelerate deep learning tasks. NVIDIA's commitment to AI extended beyond hardware; it invested in software ecosystems, creating libraries and frameworks that simplified AI development. This comprehensive approach solidified NVIDIA's position as a leader in AI, with its GPUs becoming the backbone of numerous AI applications, from autonomous vehicles to large-scale language models.

[Read More: Why GPUs Are the Powerhouse of AI: NVIDIA's Game-Changing Role in Machine Learning]

As of December 25, 2024, if you had invested US$1,000 in NVDA five years ago, it would now be worth US$23,333.

2. Microsoft Corporation (MSFT)

Microsoft has been a pioneer in integrating AI across its suite of products and services, significantly enhancing user experiences and operational efficiencies. A cornerstone of this strategy is Azure AI, a comprehensive platform offering a range of AI services that enable developers to build intelligent applications at scale. These services encompass machine learning, natural language processing, and computer vision, providing the tools necessary to create sophisticated AI solutions. Additionally, Microsoft 365 Copilot integrates AI capabilities directly into productivity applications like Word, Excel, and Outlook, assisting users with tasks such as content generation, data analysis, and workflow automation. This seamless integration of AI into everyday tools has streamlined processes and boosted productivity for millions of users worldwide.

Beyond product integration, Microsoft has made strategic investments to advance AI research and development. A notable example is its partnership with OpenAI, which has led to the incorporation of advanced language models into Microsoft's offerings, enhancing capabilities in natural language understanding and generation. Furthermore, Microsoft has developed its own AI models and tools, such as the MAI-1 model and VASA-1 for text-to-video generation, demonstrating a commitment to expanding AI functionalities across various domains. These initiatives have not only enriched Microsoft's product ecosystem but have also contributed to the company's robust financial performance, positioning it as a leader in the rapidly evolving AI landscape.

As of December 25, 2024, if you had invested US$1,000 in MSFT five years ago, it would now be worth US$2,744.

3. Alphabet Inc. (GOOGL)

Alphabet Inc., Google's parent company, has been a trailblazer in AI research and development, embedding AI across its diverse range of products and services. A significant milestone was the acquisition of DeepMind in 2014, a leading AI research lab renowned for groundbreaking projects like AlphaGo and AlphaFold. AlphaFold, in particular, has revolutionized the field of protein structure prediction, earning DeepMind's founders, Demis Hassabis and John Jumper, the 2024 Nobel Prize in Chemistry.

Alphabet's commitment to AI extends beyond research; it has seamlessly integrated AI into its core services, enhancing user experiences and operational efficiency. In 2024, the company introduced Gemini 2.0, an advanced AI model designed to improve search algorithms and automate user tasks. This innovation contributed to Alphabet's stock reaching record highs, reflecting strong market confidence.

[Read More: Google Unveils "Learn About": Transforming Education with Interactive AI Tools]

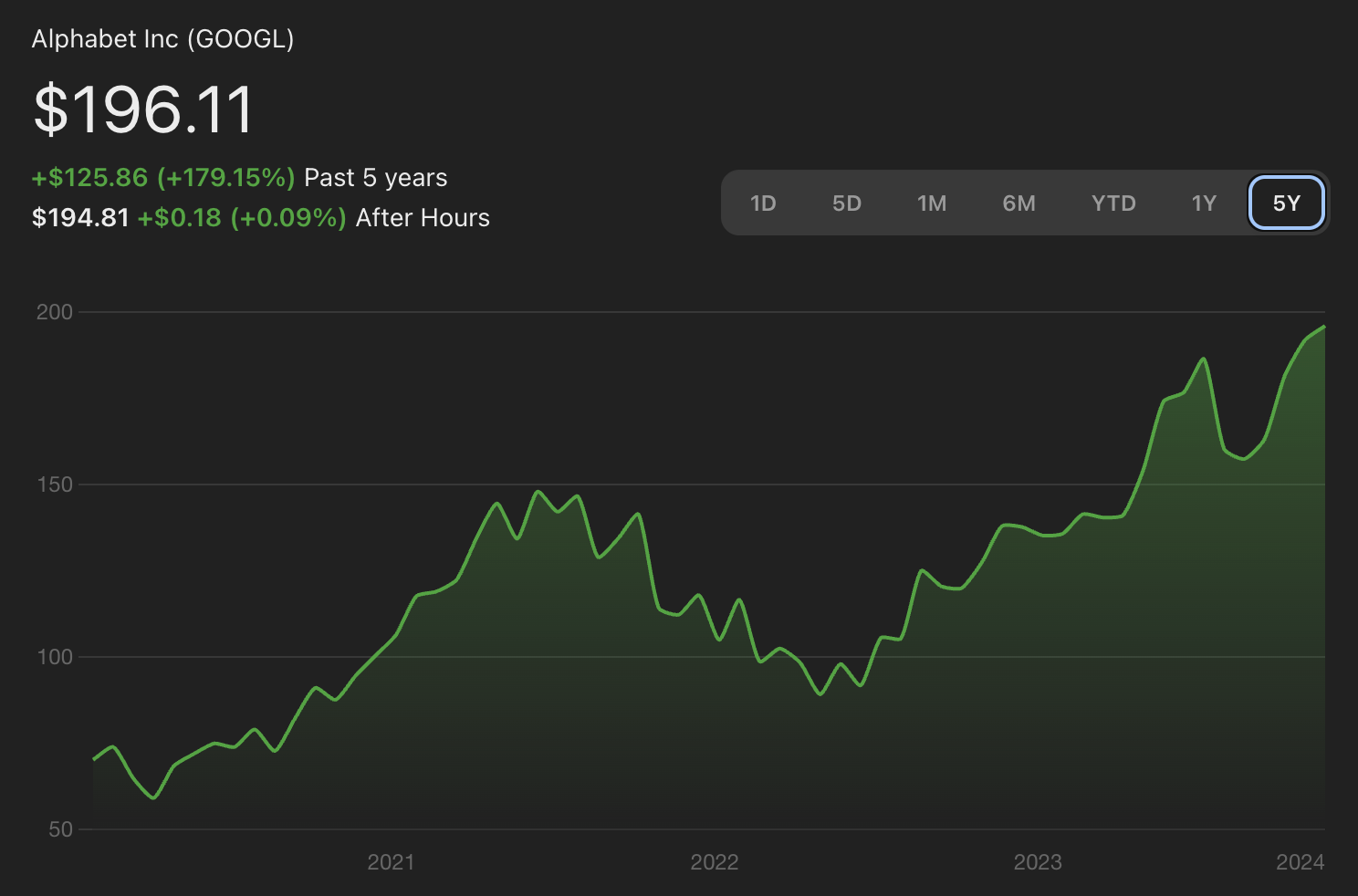

As of December 25, 2024, if you had invested US$1,000 in GOOGL five years ago, it would now be worth US$2,792.

4. Meta Platforms Inc. (META)

Meta Platforms, formerly known as Facebook, has strategically integrated AI across its services to enhance user engagement and drive revenue growth. On platforms like Facebook and Instagram, AI algorithms analyze user behavior to deliver personalized content recommendations, thereby increasing user interaction and time spent on these platforms. In the advertising domain, AI-driven tools optimize ad placements and targeting, improving efficiency and effectiveness for advertisers. For instance, Meta's AI-powered ad tools have been instrumental in analyzing vast datasets to deliver personalized content and ads to users, significantly boosting engagement and ad revenue.

Beyond its existing platforms, Meta has been investing heavily in AI research and development to pioneer new technologies and applications. A notable initiative is the development of large language models like LLaMA 3 and Sam 2, which contribute to both internal and external AI innovation. These models enhance natural language processing capabilities, enabling more intuitive and human-like interactions within the Metaverse. Additionally, Meta's AI initiatives extend to content moderation, personalized recommendations, and advertising across its platforms, further enhancing user experiences and operational efficiency.

[Read More: Meta Unleashes Llama 3.1: The Most Powerful AI - And It’s Free?]

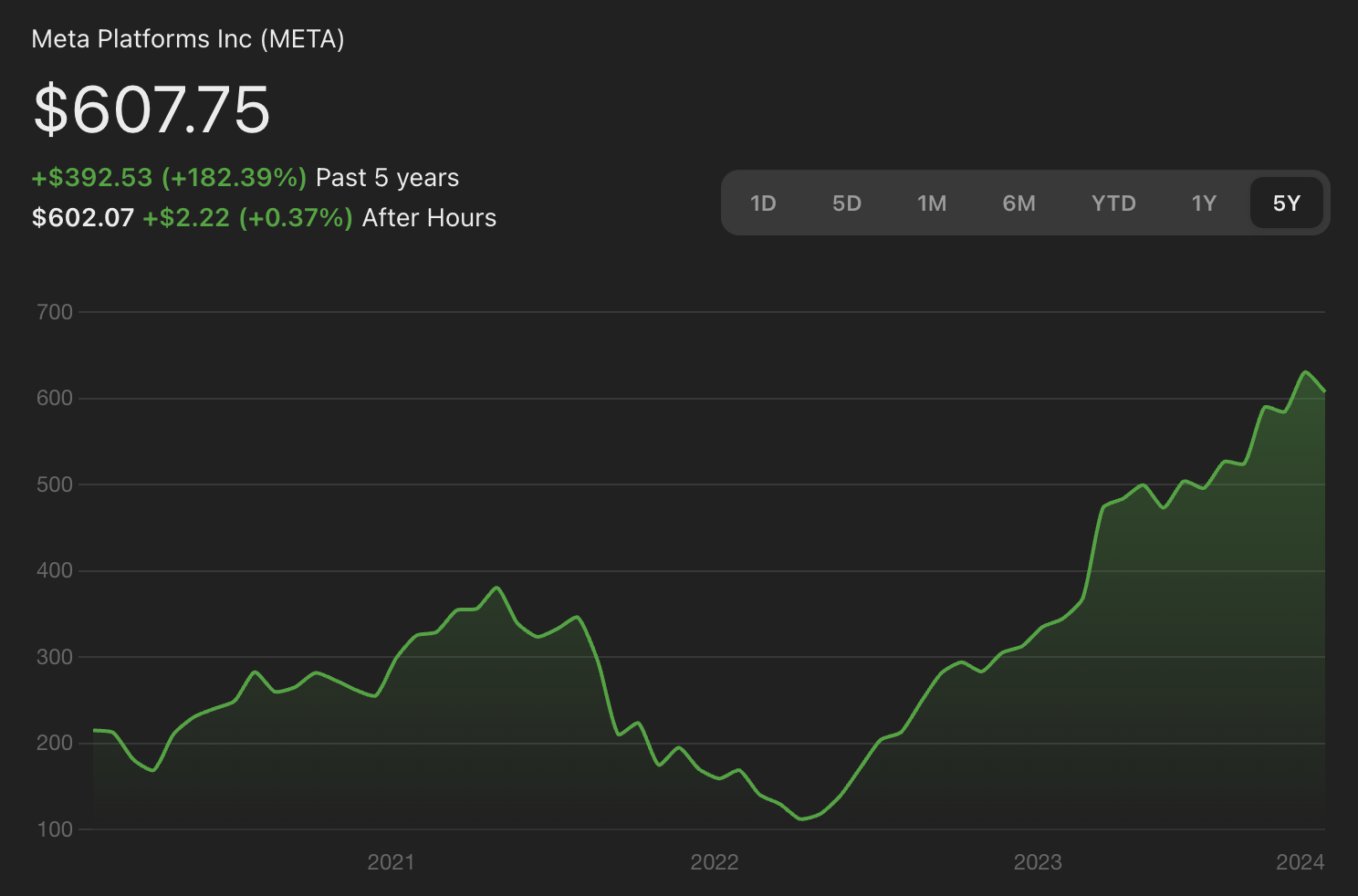

As of December 25, 2024, if you had invested US$1,000 in META five years ago, it would now be worth US$2,824.

5. Amazon.com Inc. (AMZN)

Amazon has extensively integrated AI across its operations to enhance customer experiences and streamline processes. A notable application is its personalized recommendation system, which analyzes user behavior and preferences to suggest products that align with individual tastes. This AI-driven approach has been instrumental in increasing user engagement and boosting sales. Additionally, Amazon employs AI in its voice-activated assistant, Alexa, enabling natural language processing to understand and respond to user queries, thereby enhancing user interaction and satisfaction.

In logistics, Amazon utilizes AI to optimize its supply chain and delivery processes. AI algorithms predict product demand, manage inventory levels, and determine optimal warehouse locations, ensuring products are stocked appropriately and delivered efficiently. For instance, during peak shopping periods, AI systems forecast demand for over 400 million products, enabling timely deliveries worldwide.

Furthermore, Amazon Web Services (AWS) offers AI and machine learning services, such as Amazon SageMaker, which allows developers to build, train, and deploy machine learning models at scale. This empowers businesses to incorporate AI into their operations, driving innovation and efficiency across various industries.

[Read More: Amazon Deepens Generative AI Strategy with $4 Billion Investment in Anthropic]

As of December 25, 2024, if you had invested US$1,000 in AMZN five years ago, it would now be worth US$2,421.

6. International Business Machines Corp. (IBM)

IBM has been a significant force in the field of AI, with its Watson platform providing AI solutions across various industries. Introduced in 2011, Watson gained prominence by winning the quiz show "Jeopardy!" against human champions, showcasing its advanced natural language processing capabilities. Since then, IBM has expanded Watson's applications to sectors such as healthcare, where it assists in diagnosing diseases and personalizing treatment plans, and finance, where it aids in risk assessment and fraud detection. Watson's deployment spans over 20 industries, impacting more than 100 million users worldwide.

To maintain its competitive edge in the evolving tech landscape, IBM has continued to innovate within the AI domain. In 2024, the company introduced Granite 3.0, a family of open-source AI models designed for enterprise use, emphasizing efficiency and cost-effectiveness. These models are part of IBM's broader strategy to provide scalable AI solutions that cater to the specific needs of businesses. Additionally, IBM's AI and data platform, watsonx, offers tools for training, validating, and deploying AI models, enabling organizations to integrate AI seamlessly into their operations. This focus on AI has been central to IBM's strategy to remain a leader in the tech industry, driving growth and innovation.

[Read More: IBM's AI Boom: Navigating Shifts in Consulting and Software Demand]

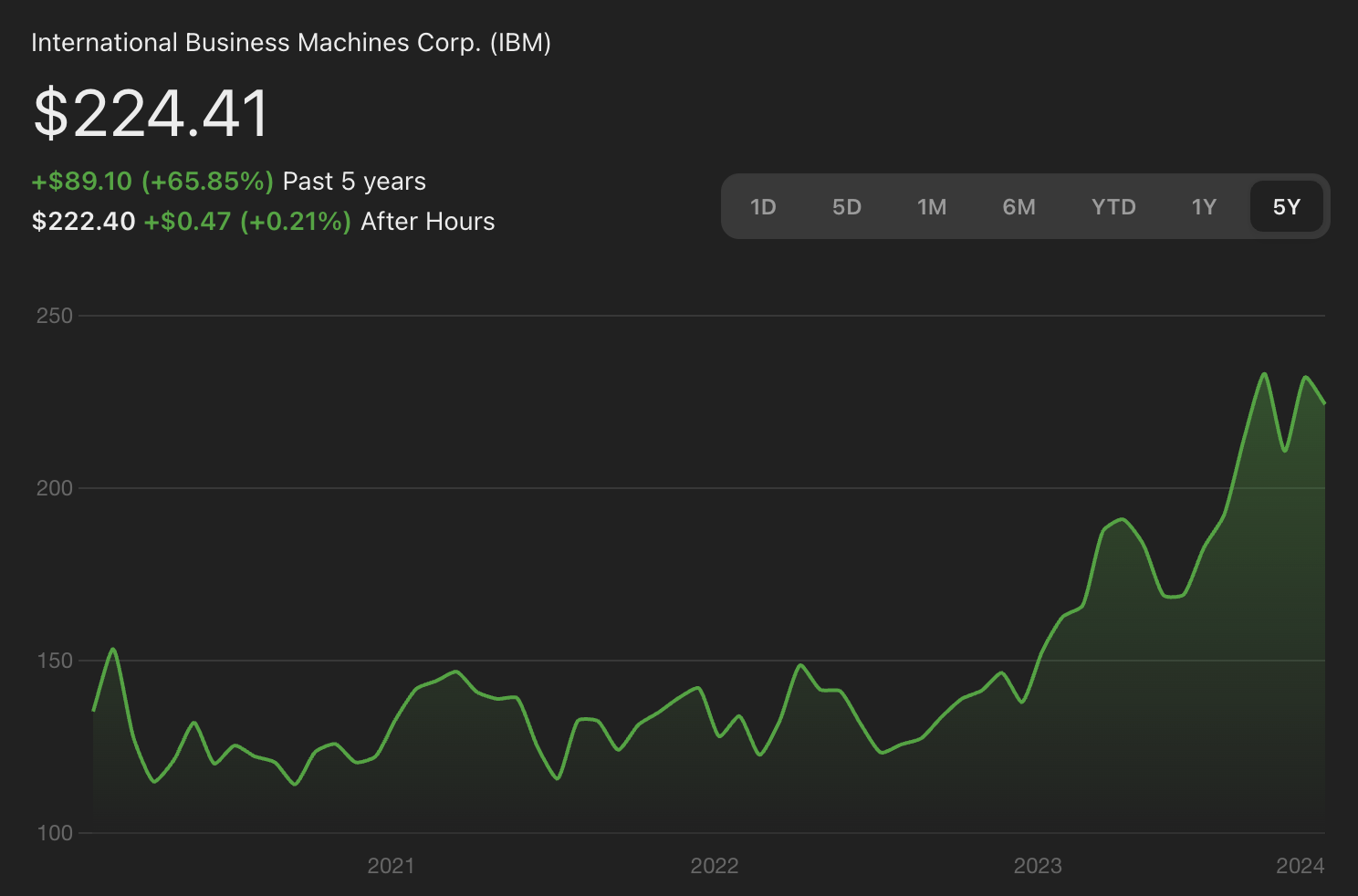

As of December 25, 2024, if you had invested US$1,000 in IBM five years ago, it would now be worth US$1,659.

7. Tesla Inc. (TSLA)

Tesla has made significant strides in AI, particularly in developing autonomous driving technologies. Central to this effort is the Full Self-Driving (FSD) system, which utilizes advanced AI algorithms and a suite of sensors to enable vehicles to navigate and make real-time decisions without human intervention. Tesla's approach relies on a vision-based system, using cameras and AI to interpret the vehicle's surroundings, distinguishing it from competitors that incorporate lidar and radar. This strategy has led to the development of features such as automatic lane changes, traffic light recognition, and urban street navigation. In 2024, Tesla announced plans to introduce the "Cybercab", a fully autonomous, pedal-less vehicle aimed at revolutionizing urban transportation.

Tesla's AI initiatives extend beyond autonomous driving; the company is investing in AI-driven robotics, exemplified by the development of the Optimus humanoid robot, which aims to perform tasks that enhance daily life.

[Read More: Tesla Unveils Cybercab & Robovan: Musk's Bold Bet on Autonomous Robotaxis by 2026]

As of December 25, 2024, if you had invested US$1,000 in TSLA five years ago, it would now be worth US$14,090.

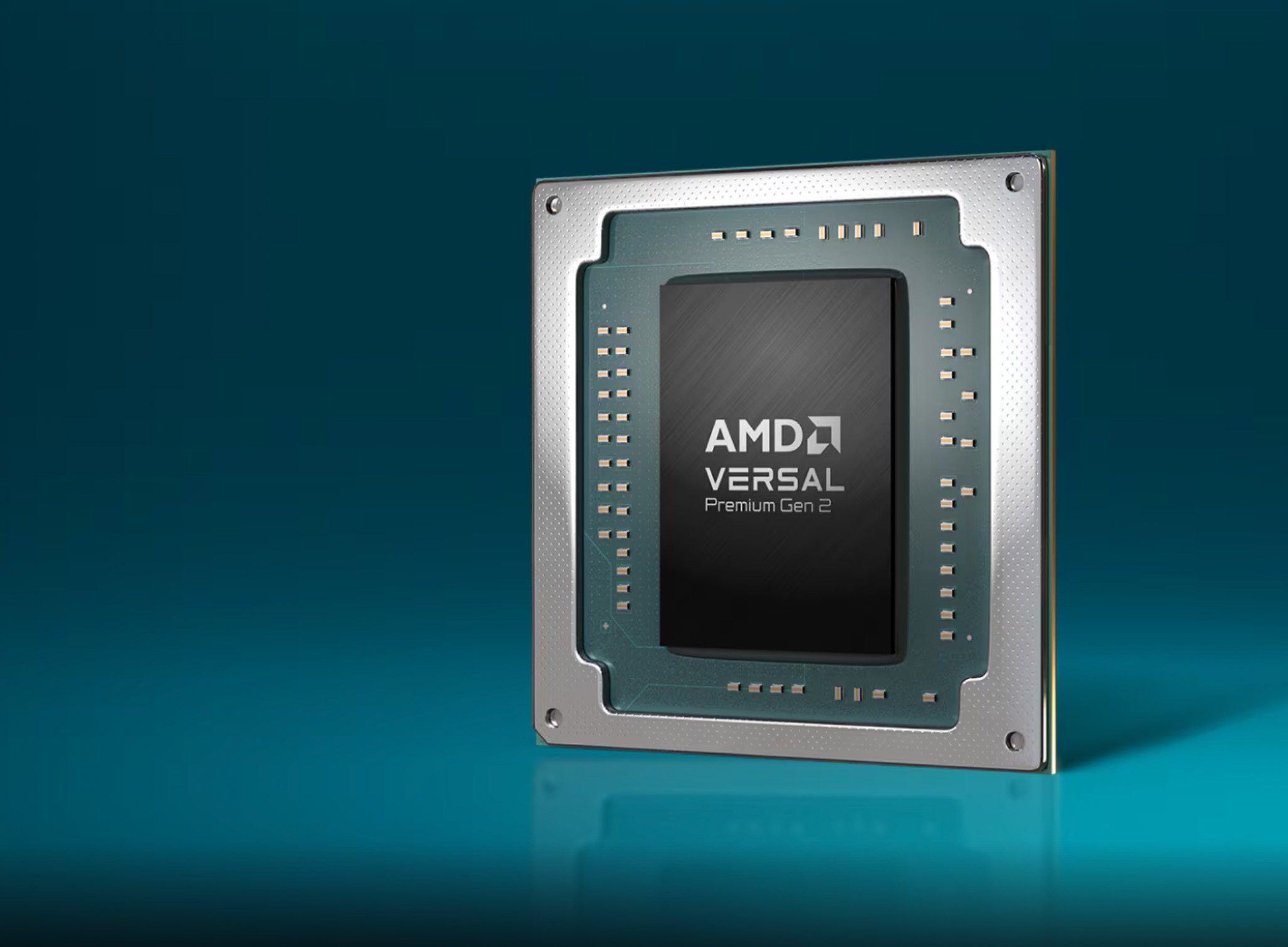

8. Advanced Micro Devices Inc. (AMD)

AMD has significantly advanced AI by developing high-performance processors and graphics processing units (GPUs) tailored for AI applications. A notable achievement is the introduction of the AMD Instinct MI325X GPU, designed to accelerate AI workloads in data centers. The MI325X incorporates 256 gigabytes of high-bandwidth memory (HBM3E) and delivers performance that, in certain inference benchmarks, surpasses competitors like Nvidia's H200 GPU by up to 40%. This GPU is scheduled for production shipments in the fourth quarter of 2024, with availability from partners such as Dell and Hewlett Packard Enterprise in early 2025.

In addition to GPUs, AMD has enhanced its central processing units (CPUs) to support AI workloads. The fifth-generation EPYC processors, codenamed "Turin", offer up to 17% higher instructions per cycle for general workloads and up to 37% improved performance in AI and high-performance computing tasks. These advancements have bolstered AMD's reputation and revenue, driving a shift in customer preference away from competitors. Furthermore, AMD's Ryzen™ AI processors are the first Windows laptop PC processors in their class ready for next-generation AI experiences, featuring a dedicated AI engine powered by AMD XDNA architecture.

[Read More: AMD Unveils MI325X AI Chip, Plans MI350 Series to Compete with Nvidia's AI Dominance]

As of December 25, 2024, if you had invested US$1,000 in TSLA five years ago, it would now be worth US$2,640.

9. Intel Corporation (INTC)

Intel Corporation has strategically invested in AI by developing specialized hardware and acquiring AI-focused companies to strengthen its position in the rapidly evolving tech landscape. One significant move was the acquisition of Habana Labs in December 2019 for approximately $2 billion. Habana Labs, an Israel-based developer of programmable deep learning accelerators, brought expertise that enhanced Intel's AI capabilities, particularly in data center environments.

In addition to acquisitions, Intel has been developing its own AI-optimized hardware. The company introduced the Gaudi series of AI accelerator chips, with Gaudi 3 unveiled in December 2023. These chips are designed to compete with offerings from rivals like Nvidia and AMD, aiming to provide efficient solutions for generative AI workloads. Furthermore, Intel's collaboration with Amazon Web Services (AWS) to produce custom AI fabric chips using its advanced process node, Intel 18A, underscores its commitment to delivering high-performance, energy-efficient solutions for AI applications.

Despite these efforts, Intel's stock has seen a significant decline over the past five years. This downturn can be attributed to intense competition from AMD and NVIDIA, which have gained substantial market share with superior products in CPUs and GPUs, including AI-specific hardware. Additionally, delays in rolling out advanced manufacturing processes, such as the transition to 7nm and 5nm nodes, have hindered Intel's ability to keep pace with industry trends, eroding investor confidence. While Intel has made strides in AI, these initiatives have not yet yielded substantial financial gains to offset challenges in its core markets, such as data centers and personal computing. The perception of being slow to innovate and a shift in consumer preferences toward competitors have further weighed on the company’s stock performance.

However, investors may find Intel an attractive stock to watch at its current low valuation. With its stock price significantly reduced, it presents an opportunity for potential upside if the company can execute its strategy effectively. Intel's commitment to AI, combined with its collaborations and ongoing innovation in hardware development, could position it for a turnaround. Should the company resolve its manufacturing delays, regain market share, and capitalize on the growing AI market, its stock price could experience a meaningful recovery, making it a potential value play for long-term investors.

[Read More: Revolution in Silicon: Intel's Falcon Shores AI Chip Sets New Benchmarks]

As of December 25, 2024, if you had invested US$1,000 in INTC five years ago, it would now become US$346.

10. Salesforce Inc. (CRM)

Salesforce has significantly enhanced its Customer Relationship Management (CRM) platform by integrating AI through its Einstein AI suite. Introduced in 2016, Einstein AI encompasses a range of capabilities, including machine learning, natural language processing, and predictive analytics, all designed to automate and optimize various business processes. In sales, Einstein provides features such as lead scoring and opportunity insights, enabling sales teams to prioritize prospects more effectively and forecast sales with greater accuracy. In customer service, Einstein Bots handle routine inquiries, allowing human agents to focus on more complex issues, thereby improving response times and customer satisfaction. In marketing, Einstein assists in segmenting audiences and personalizing content, enhancing engagement and conversion rates.

Building upon the success of Einstein, Salesforce has continued to innovate in the AI domain. In December 2024, the company unveiled Agentforce 2.0, an advanced AI-driven platform that integrates seamlessly with tools like Slack. This platform enhances automation and decision-making capabilities, enabling businesses to deploy intelligent agents that can perform tasks autonomously, such as managing customer interactions and streamlining workflows. The introduction of Agentforce 2.0 has been met with positive reactions from industry analysts, who anticipate that it will drive significant growth for Salesforce by meeting the increasing demand for AI-powered solutions in enterprise environments.

[Read More: AI Stocks in Focus: Opportunities and Challenges Amid Generative AI Surge]

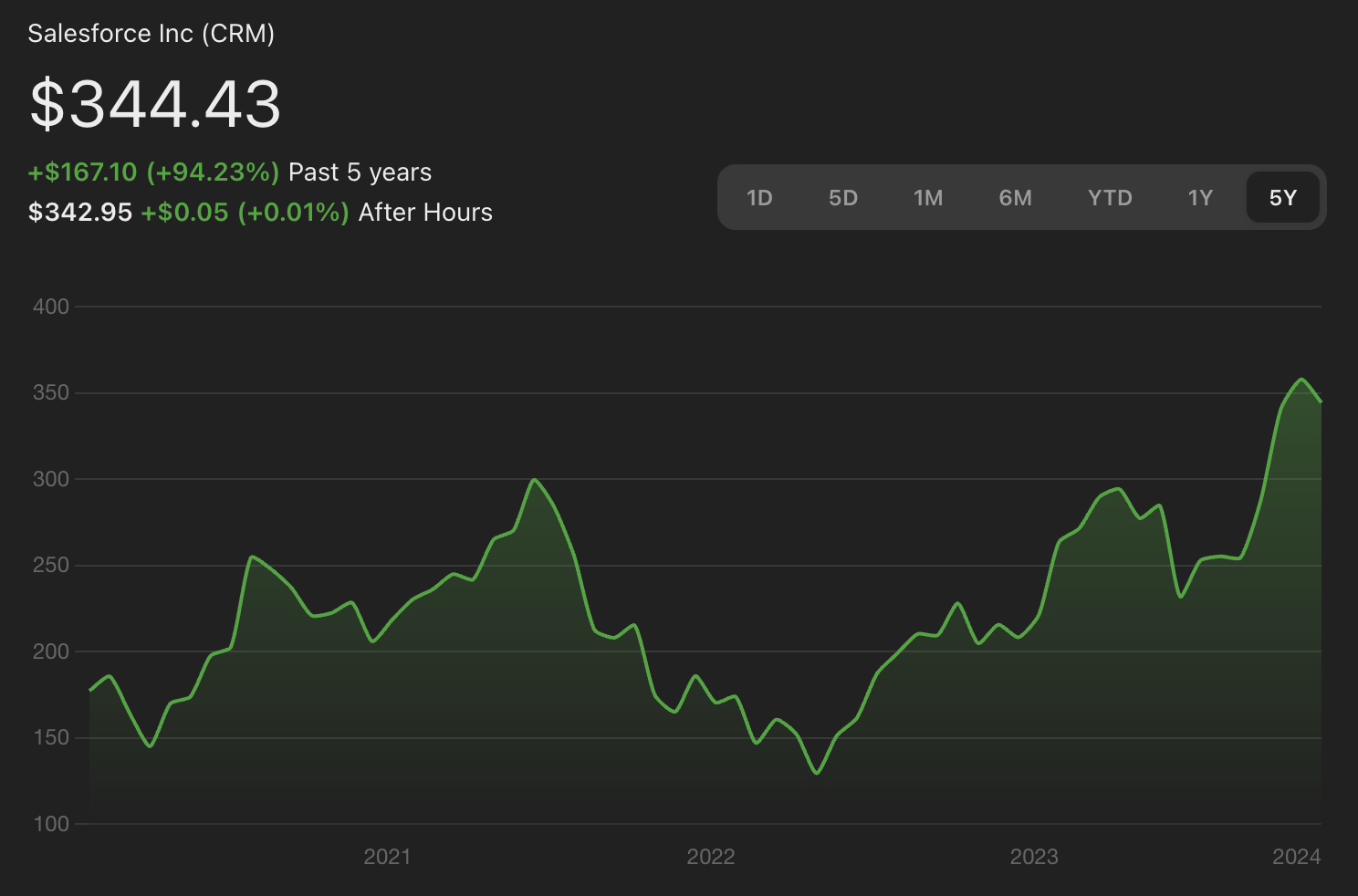

As of December 25, 2024, if you had invested US$1,000 in CRM five years ago, it would now be worth US$1,942.

Investment Strategy: Long-Term Growth Through Diversification

Investing in AI-related stocks offers substantial growth potential, but it's essential to approach this sector with a diversified strategy. By spreading investments across multiple companies, investors can mitigate risks associated with market volatility and company-specific challenges. Regular, monthly investments—known as dollar-cost averaging—allow investors to purchase shares at varying price points, reducing the impact of short-term price fluctuations and eliminating the need to time the market.

For instance, if you had invested US$100 in each of the 10 aforesaid AI-related stocks five years ago (a total of $1,000), your portfolio would now be worth approximately US$5,479—a 5.5x growth. Annualizing this growth equates to an impressive 40% return per year. By maintaining a disciplined, monthly investment habit over the next 10 years, your portfolio could grow exponentially, potentially reaching US$1.2 million, assuming a similar rate of return.

While we encourage people to consider investing as a pathway to achieving financial freedom, it’s important to note that this article is not recommending any specific stocks. Every individual has unique financial goals, risk tolerance, and investment timelines. Whether you are risk-taking or risk-averse, it’s essential to choose investments that align with your needs and circumstances. Consulting with a financial advisor can help tailor an investment strategy that works best for your specific situation.

[Read More: How AI Will Reshape the Global Economy: Insights from IMF Forum]

Source: Wikipedia, Codemotion, Microsoft, Business Insider, Business Insider, Barron's, Finbox, Analytics Insight, Swift, About Amazon, Sifted, Wikipedia, IBM, AI Magazine, Le Monde, Business Insider Markets, New York Post, Barron's, All About AI, AMD, Intel Corporation, Wikipedia, Forbes, Reuters, MarketWatch, Salesforce, Barron's